The Polymath’s Equilibrium: The $1.4 Trillion Bet and the Federal Strike for "Order"

Last week, we analyzed the "physics of the echo chamber"—how closed systems in Silicon Valley create structural blind spots. This week, the system didn’t just grow; it attempted to redefine the very laws of its own gravity.

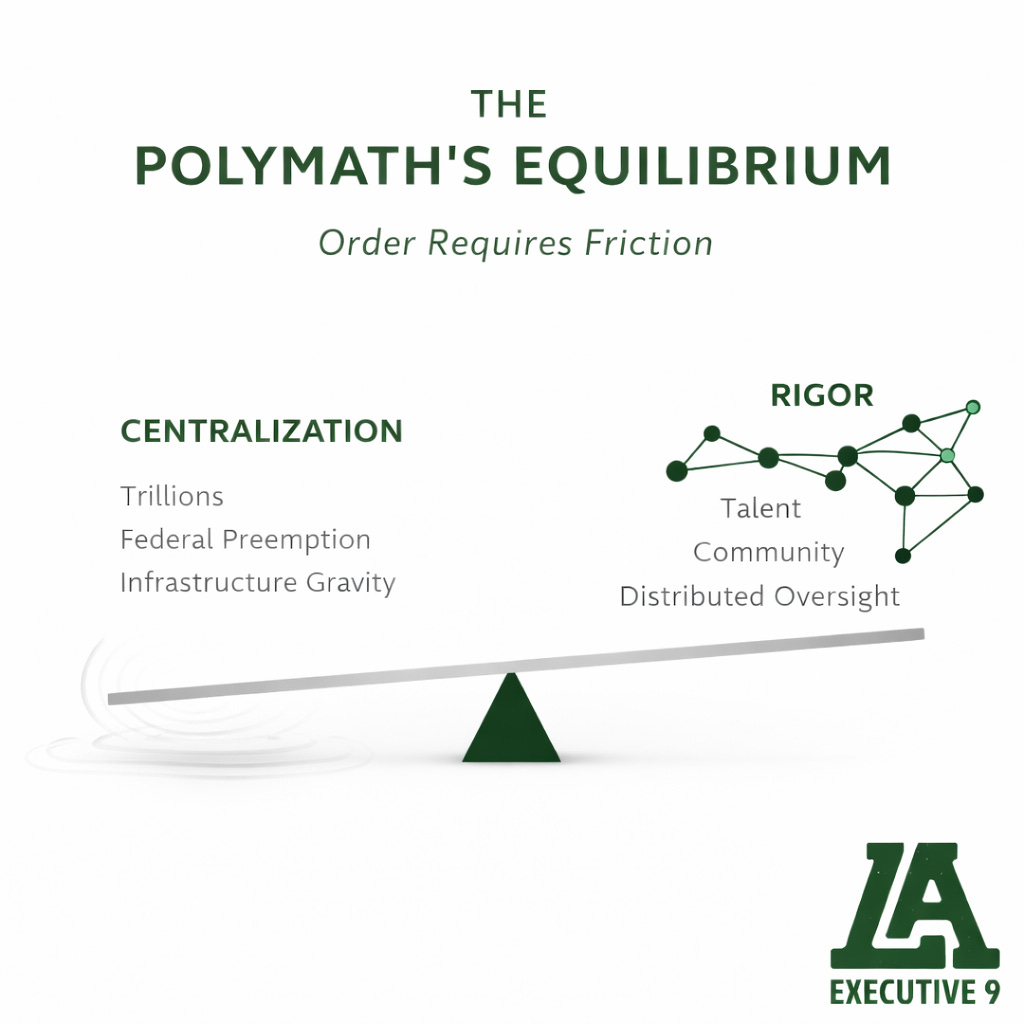

Between OpenAI’s staggering $100 billion funding discussions and a landmark White House Executive Order designed to preempt state AI laws, we are seeing a massive, coordinated attempt to build a "centralized future." But as a physicist and a lawyer, I know that for every action, there is an equal and opposite reaction.

I. The Entropy of Trillions: OpenAI and the Infrastructural Frenzy

The numbers coming out of the "AI Bubble" this week are no longer just large—they are geological.

OpenAI is reportedly in talks to raise up to $100 billion at a valuation approaching $800 billion.

Amazon is circling a $10 billion stake, while Disney has dropped $1 billion to bring Sora into its magical kingdom.

Most tellingly, OpenAI is planning a $1.4 trillion spend on infrastructure over the next eight years.

To put $1.4 trillion in perspective: that is the GDP of a top-tier global economy. In thermodynamics, when you pump that much energy into a system without a corresponding increase in efficiency (quality), you don’t just get growth—you get entropy.

The "Polymath’s question" remains: Is this a bet on long-term utility, or is it the ultimate "narrative battle" to ensure that the bubble never pops because it is simply "too big to fail"? When corporations start spending like nation-states, they are no longer just building products; they are attempting to build a sovereign ecosystem.

II. The Regulatory Preemption: A New "Centralizing Force"

While the capital side of the house is expanding, the regulatory side is attempting to "narrow the field." On December 11, the White House issued an Executive Order on Ensuring a National Policy Framework for AI. The goal is clear: Federal Preemption. By attempting to block states from enacting their own "cumbersome" AI regulations and forming an AI Litigation Taskforce to challenge state-level friction, the administration is trying to create a "safe harbor" for innovation.

As someone who has navigated global regulatory analysis from Wall Street to the digital asset industry, I see the strategic trap here. While "minimally burdensome" standards sound like a win for efficiency, centralizing all regulatory power into a single federal framework removes the "necessary friction" that protects the public. Strategic clarity doesn't come from removing rules; it comes from having the right ones. By preempting the states, we risk losing the diverse, decentralized oversight that prevents systemic failure.

III. Tangible Value: The Field vs. The Cloud

In a week defined by ephemeral AI valuations, we see a grounding "corrective" in the world of sports and corporate M&A.

The Hoffmann family is reportedly in final stages to buy the Pittsburgh Penguins for nearly $1.8 billion.

Wasserman expanded its footprint in women’s soccer, and Juventus reportedly stood its ground by rejecting a bid from the crypto giant Tether.

These deals represent foundational capital. Unlike an AI model that could be "delusional" (as state AGs warned this week), a sports franchise has a quantifiable, community-anchored physical presence. This mirrors our focus at Deal Team SIXX: identifying assets where the value is rooted in community and operational excellence, not just a surging cloud-based narrative.

IV. The New South Corrective: Talent over Trillions

While Silicon Valley looks for trillions, the New South is looking for talent. We see the true "strategic opportunity" in the grassroots grit of our own ecosystem:

The Georgia Tech Gift: Christopher Klaus’s continued pledge to cover incorporation costs for startup-founding graduates is the ultimate "New Washingtonian" act. It’s about lowering the barrier to entry for the individual, not the institution.

HBCU Pathways: The expansion of the Georgia Power and Atlanta Hawks HBCU Pathways program for its fourth year is how we build a durable talent pipeline. By involving students from Morehouse, Spelman, and Clark Atlanta in the real-world operations of sports and business, we are creating "polymaths" who understand the intersection of culture and capital.

As a Founder-Creator-Investor (FCI), my partner AJ and I are focused on this specific intersection. We believe the future isn't just about how much "compute" you can buy with a trillion dollars; it’s about the intellectual rigor of the minds building the models.

The path of the polymath requires us to look past the federal preemption and the trillion-dollar infrastructure bets to find where the real quality lives—in the classrooms of the AUC, the labs of Georgia Tech, and the grit of founders building outside the bubble.

The Resolution remains the same: Do not let the scale of the hype distract you from the necessity of the rigor.

For those seeking to strategically navigate this journey, Join The Path of The Polymath below.

Strategic Clarity Question for the Week: If the federal government succeeds in preempting state AI laws, will your business be safer, or will it simply be more vulnerable to a single point of failure?